Thailand's online retail market is bracing for stiffer business conditions in 2017 as companies face growing competition from foreign behemoths with deep pockets and worldwide marketing networks.

Online sales are expected to continue growing as consumers increasingly turn to the web for their purchases and away from traditional stores, thanks to nationwide high-speed wireless broadband access and the proliferation of smartphones and smart devices.

Cross-border e-commerce will gain momentum. Chinese e-commerce giant Alibaba Group recently announced that it would bring more Chinese products to sell in Thailand through the Lazada website, in which Alibaba has taken a controlling stake.

Alibaba Group invested US$1 billion (35.8 billion baht) for control of Lazada Group SA, bringing the Chinese e-commerce giant to Southeast Asia and closer to its goal of shedding its home-market reliance.

Ezbuy, a Singaporean e-commerce website, meanwhile, has expanded its footprint into Thailand to pave the way for online cross-border trading.

Thailand's online market is quite attractive due to its population size, savvy users and strong digital spending. These factors have drawn international e-commerce firms to the market.

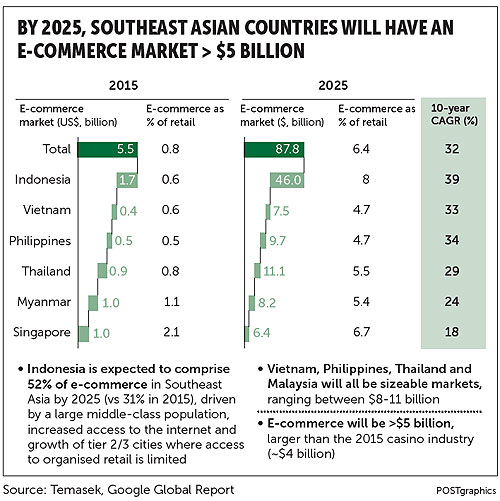

Research conducted jointly by Google and Singapore's Temasek projected that Thailand's e-commerce market would expand by a compound average growth rate (CAGR) of 29% in 2016, up from US$900,000 in 2015, eventually reaching $11 billion in 2025.

The report assessed Thailand as a young, increasingly affluent country with 58% of the population below the age of 40, noting that in 2011 the country's status was upgraded to "upper middle income" by the World Bank.

Thailand is also a highly connected country with 57% of the population having access to the internet, while over 85 million mobile subscribers (a 125% penetration rate) are on 3G and 4G.

These connections are the second fastest in Southeast Asia, with download speeds averaging 19.82 megabits per second.

Pawoot Pongvitayapanu, president of the Thai e-Commerce Association and also founder of Tarad.com, says the local e-commerce market will continue growing between 25-30% in 2017, driven mainly by the proliferation of social commerce, greater choices and innovative services from multiple logistics and fulfilment players.

In addition, growing maturity among online shoppers is making Thais more confident when shopping online, he says. Thailand is estimated to have 10-15 million online shoppers and around 1 million individual sellers and online SME merchants.

PromptPay is another driver as it will change consumer behaviour, encouraging them to pay online rather than paying cash on delivery.

But Mr Pawoot is concerned about how local SMEs will compete with Chinese products, which are cheaper than locally-made ones.

"Intense competition from international e-commerce players will increasingly put pressure on local e-marketplace providers," he says.

The e-commerce market in Southeast Asia including Thailand is entering a stage of consolidation, with only a few global cash-rich players surviving in the industry.

2016 marks the transition year for the e-commerce market in Thailand and the region, evidenced by Ensogo and Rakuten closing down their business units in the region.

Alibaba Group Holding acquired a controlling stake in Lazada after a US$1-billion deal. Zalora, the fashion-focused e-commerce site, in May sold its business in Thailand and Vietnam to Thailand's largest retail player, Central Group.

The entry of global players will lift e-commerce standards and capabilities in the region and Thailand.

More importantly, the development can be expected to create an e-commerce ecosystem that allows consumers and companies to offer all aspects of their businesses online.

Pawoot Pongvitayapanu, founder of Tarad.com, Thailand's leading e-commerce site, says that since Alibaba's acquisition of Lazada there has been no investment lending in the region's e-commerce market, as investors are reluctant to compete with the Chinese e-commerce giant.

He urged e-commerce firms to develop niche marketing strategies with the right business models in order to reduce their cash-burn rate and boost revenue growth.

Punnamas Vichitkulwongsa, chief executive of Ascend Group, the parent firm of Ascend Commerce, says Thailand's online retail market is expected to grow by 30% over the next few years, fueled by increasing smartphone penetration and intense competition among e-commerce operators.

The government's PromptPay service under the national e-payment scheme will further stimulate the adoption of mobile payment that will inevitably encourage e-commerce.

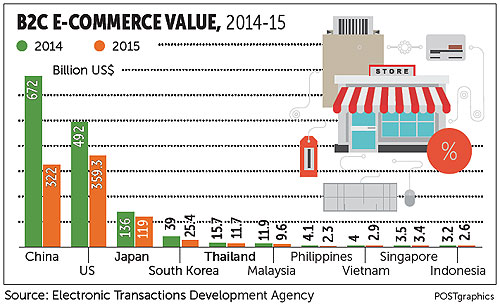

Mr Punnamas says e-commerce companies in Thailand needed to adjust and improve to compete with foreign players. Online retail commerce accounted for 2% of Thailand's total retail market in 2015, valued at 50 billion baht.

"We expect online commerce to make up 10% of the country's total within five years," says Mr Punnamas.

By comparison, that rate is 15.9% in China and 7% in the US.

But he says Thailand is quite advanced in terms of mobile commerce as it accounts for 49% of total e-commerce, compared with 49% in China and 22% in the US.

Thailand's smartphone penetration rose from 43% in 2013 to 61% in 2015. It is further expected to reach 80% in 2017.

"Thailand's e-commerce market will only have two dominant players", says Mr Punnamas.

One, Ascend Commerce, has strong financial backing from parent firm Charoen Pokaphan Group.

He says brand and e-commerce operators will have to blend their online and offline shopping experiences or use multi-channel or omni-channel sales approaches.

They also need to use mass customisation procedures to appeal to customers, as well as employ data analytics to get real-time insight into shoppers' behavioural traits and preferences.

Global marketing research firm Nielsen forecasts that Thailand's online retail e-commerce market, excluding online travel, will reach US$3 billion by 2020, up from $1 billion in 2015.

Alessandro Piscini, chief executive of Lazada Thailand, says Lazada is working with Alibaba to apply its platform and logistics and payment systems to drive the market.

Mr Piscini says the synergy between Alibaba and Lazada can be used to support local retailers and manufacturers in expanding to cross-border markets successfully. Chinese retailers and manufacturers will also be able to sell their products in Thailand through Lazada's website.

Despite this massive opportunity, SMEs are still relying on manual and cumbersome processes to operate their e-commerce businesses. Once orders are received (often through Facebook Messenger or Line) and packaged, merchants have to go visit their local post offices to ship them.

ACommerce, a leading e-commerce service provider in Southeast Asia, says e-commerce is booming in Thailand, with the market value expected to reach $51 billion by 2025, up from $1 billion at present.

Phensiri Sathianvongnusar, chief operating officer of aCommerce Thailand, says a huge driver of e-commerce growth in Thailand are entrepreneurial SMEs who are selling products on social media platforms as well as in marketplaces like Lazada.

There are several estimates suggesting one-third to half of Thailand's gross merchandise value is generated on Facebook, Instagram and Line.

But 75% of e-commerce payments in Thailand are made via cash on delivery, meaning merchants are foregoing customers who cannot pay through bank transfers, says Ms Phensiri.