Aberdeen Asset Management (Thailand) Limited, a subsidiary of abrdn plc, has introduced the "abrdn China A Share Sustainable Equity Fund" (ABCA).

This fund focuses on sustainable investments in Chinese stocks that possess unique strengths. The master fund carefully selects high-quality stocks through in-depth analysis and incorporates environmental, social, and governance (ESG) considerations in its investment strategy to support outstanding performance. The fund's investment focus revolves around five key themes: domestic consumption, technology, clean energy, asset and wealth management, and healthcare. These themes benefit from China's economic growth and government support policies. The IPO for the fund will take place between June 6 and June 16, 2023.

Mr. Robert Penaloza, Chief Executive Officer of abrdn Thailand, stated that amidst concerns of a recession in developed markets like the United States and Europe, investors are increasingly interested in Chinese stock markets. China stands out due to its still-growing economy and the government's accommodative monetary policy. Additionally, fiscal policies conducive to driving growth contribute to China's sustainable recovery.

Mr. Robert further explained, "abrdn recognises the attractiveness of the A-Shares market, particularly the recovery in China's consumption sector. We anticipate that the consumption sector will be the main driver of China's overall economic growth in the second half of this year. Furthermore, China A Shares are currently undervalued, contrary to the recovering performance of companies in the A-Shares market. This presents an opportunity for long-term investors to acquire quality assets at attractive prices and serves as a favourable alternative for portfolio allocation."

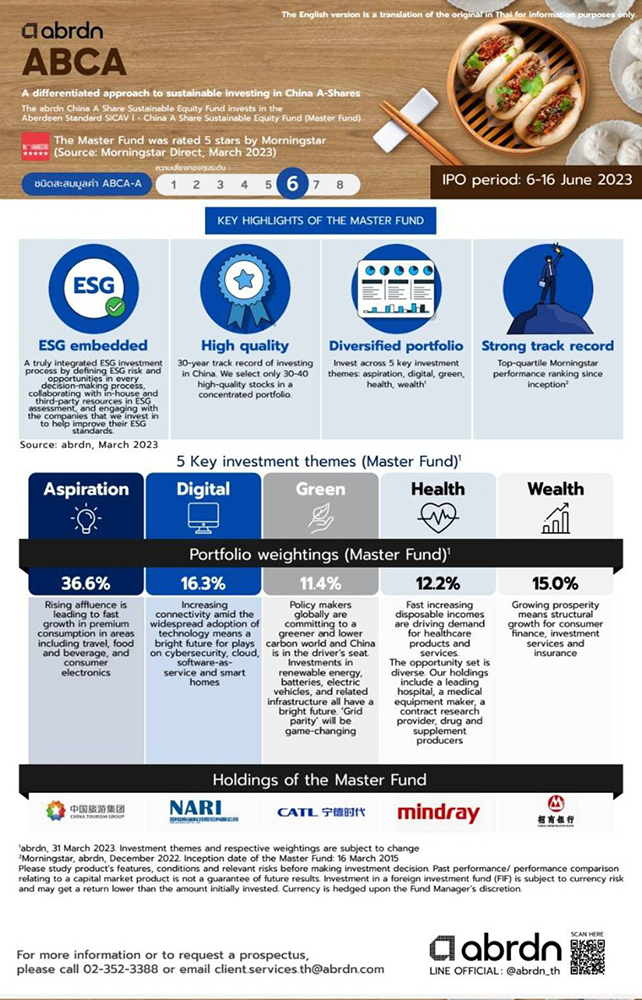

abrdn Thailand is preparing to launch the abrdn China A Share Sustainable Equity Fund (ABCA) as a Feeder Fund, which primarily invests in China A Shares. The fund carries a risk level of 6 and maintains a policy of investing at least 80% of its Net Asset Value (NAV) in equities throughout the year. It achieves this by investing through investment units of the Aberdeen Standard SICAV I – China A Share Sustainable Equity Fund (Master Fund), which has received a 5-star overall rating from Morningstar (Source: Morningstar Direct, March 2023).

The master fund's distinctive features include:

ESG embedded: The fund incorporates abrdn's ESG criteria and benchmarks from other sources, conducting in-depth analysis throughout the investment process, from stock selection to assessment and grading. abrdn also actively supports companies that invest in ESG development.

High quality: The portfolio consists of only 30-40 high-quality stocks, selected by a team with over 30 years of experience in Chinese stocks.

Diversified portfolio: The fund diversifies across five main themes, with a focus on domestic consumption, technology, clean energy, asset and wealth management, and healthcare.

Strong track record: The fund has demonstrated outstanding performance, consistently ranking in the top quartile since its inception (Source: Morningstar, abrdn, December 2022, Fund inception March 16, 2015).

Thanks to these distinctive features, the master fund has positively impacted the investment portfolio. As of March 2023, the debt-to-equity (D/E) ratio stood at negative 22%, indicating the fund's strategy of avoiding investment in companies with high levels of debt. Moreover, the return on equity (ROE) ratio surpasses the benchmark, reflecting the high-growth stocks in the portfolio with lower debt levels compared to the benchmark (Source: abrdn, Factset, data as of March 2023).

When it comes to investment themes, the fund focuses on five key areas that will benefit from the growth of the Chinese economy and government support policies. These themes are as follows:

Aspiration Theme: This theme centers around domestic consumption driven by the increasing wealth of Chinese individuals, leading to rapid growth in the consumption of premium goods and services such as tourism, food and drink sectors, as well as personal electronic devices (portfolio weight of 36.6%).

Digital Theme: This theme focuses on digital connectivity, which is currently experiencing widespread adoption of technology and reflects a promising future for cybersecurity, cloud business, software providers, and smart homes (portfolio weight of 16.3%).

Green Theme: This theme revolves around clean energy, with China being a leader in driving renewable energies, battery manufacturing, electric vehicles, related infrastructure, and environmental management for the future (portfolio weight of 11.4%).

Health Theme: The health care theme emphasizes the rising Chinese income trends that enable people to have purchasing power and take better care of their health. This has a positive effect on leading hospital businesses, medical device manufacturers, and health care products and services (portfolio weight of 12.2%).

Wealth Theme: This theme focuses on the asset and wealth management industry in China, which is experiencing significant structural growth. This growth has a positive effect on consumer finance, business investment services, and insurance businesses (portfolio weight of 15%) (Source: abrdn, data as of March 31, 2023. Investment themes and respective weightings are subject to change).

For example, the master fund invests in stocks such as China Tourism Group Duty Free, a leading duty-free shop in China supported by the Chinese government's policies to encourage domestic spending among Chinese travelers. Other investments include Nari Technology, a leading technology company in China specializing in innovative products and services like artificial intelligence (AI), robotic process automation (RPA), and cloud services.

Other investments comprise CATL, China's top electric vehicle battery manufacturer with a significant global market share, Shenzhen Mindray, China's largest medical device manufacturer with a range of health products and high market shares in America and Europe, and China Merchants Bank, a financial service provider known for its strength in retail banking and wealth management business that is experiencing rapid growth (Source: abrdn, March 2023. Investment themes and respective weightings are subject to change).

To ensure you don't miss out on unique investment opportunities for sustainable growth in the Chinese stock market, the ABCA Fund is offered as an Accumulation Class (ABCA-A). Take advantage of the

opportunity to earn returns from the long-term increase in the investment unit value. The IPO will take place between June 6 and June 16, 2023.

Special offer! Investors can open an account to invest through the abrdn mobile application today. Simply search for "abrdn" on the App Store or Play Store. Investors who open an account from today until June 30, 2023, will receive a 200 baht Starbucks e-voucher (terms and conditions apply). For more information, please visit https://www.abrdn.com/en-th/investor/what-we-do/abrdn-china-a-share-sustainable-equity-fund. To request a prospectus, please call 02-352-3388 or email client.services.th@abrdn.com.

Please note that past performance or performance comparisons relating to a capital market product do not guarantee future results. It is important to thoroughly study the product's features, conditions, and relevant risks before making an investment decision.

Investing in a foreign investment fund (FIF) carries currency risk and may result in a return lower than the initial investment amount. Currency hedging is at the discretion of the Fund Manager